Sunday, June 1, 2008

Weekend round-up

Monday, May 19, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

Online property sales probed - Australia

Moody's: Commercial real estate prices slipping - USA

Real estate sector growth trends - Bulgaria

5-10 percent European property fall

Real estate wary of hot foreign money - UAE

Al Gharbia set to become a real estate hot spot - UAE

Israel is still a hot market for high-end real estate

Africa: Asset Managers Look to Continent

Japan faces backlog of unsold homes

Wednesday, May 14, 2008

REIT's and Real Estate Funds

Looking for the next real estate play? Real Estate Investment Trusts and Real Estate Funds are worth a look.

In the US, a Wall Street Journal article states; "The average real-estate fund, which lost more than 14% on average in 2007, is up nearly 5.6% this year through May 12, which makes it the second-best performing U.S. stock fund group this year, behind the hot natural-resources funds category."

The Jerusalem Post in Israel quoted; "The current crisis that started with the sub-prime fiasco has [affected] real estate prices all over the world. It is now possible to buy real estate for rental purposes at prices that are lower by up to 20% from a year ago, and I believe prices will fall more. The current prices are hurting many, but for those companies or individuals with ready cash, it has created attractive investment opportunities. "

If you are interested in these real estate investment vehicles, China is one of the places to put on your radar. A storey in The Sydney Morning Herald printed this; "As the fastest growing real estate market, with substantial commercial property assets that are of investment grade, China has the potential to be an REIT phenomenon if the legislation for such a market is put in place."

Final Thoughts: There are several real estate markets around the world that are still growing.

In markets such as the US, the price to get into these types of investments are cheap compared to previous levels.

There is talk out there in the msm covering how these trusts and funds got beat down in 2007 and the upside potential that is beginning to take shape. Now is the time to investigate. If you wait to hear about it on the evening news before you make a move...well need I say more.

Today's Quote: Owning a home is a keystone of wealth.. both financial affluence and emotional security. Suze Orman

Tuesday, May 13, 2008

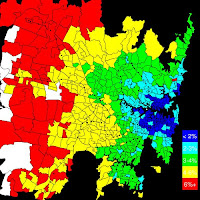

Well, it used to be cheap to live in the burbs

The main article behind the post talks about the rising cost of fuel cutting into the family budget for car-dependant commuters. Fuel prices in Sydney are approaching $1.50 per litre and some estimate it could rise to $2.00 over the next couple years which would equate to about 6% of income for those who commute. Add to this an inadequate transit system and the lack of government to fast track alternative fuel research some are worried a serious crisis will develop.

Sunday, May 11, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

International Real Estate Investment: What Investors Should Know - General

Media to blame for slump, say real estate agents - New Zealand

Global wealth boom to trigger a 77pc surge in millionaires - World

India Real Estate Expo 2008 - USA

REAL ESTATE: Outlook tough for sellers - USA

Foreign buyers snap up US real estate - USA

Property in the Caribbean: St Lucia goes bananas for property - Caribbean

Can UAE real estate boom dodge US slow down? - Middle East

International buyers eye Canadian real estate - Canada