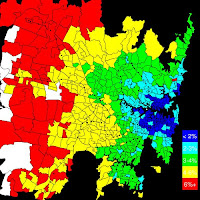

The main article behind the post talks about the rising cost of fuel cutting into the family budget for car-dependant commuters. Fuel prices in Sydney are approaching $1.50 per litre and some estimate it could rise to $2.00 over the next couple years which would equate to about 6% of income for those who commute. Add to this an inadequate transit system and the lack of government to fast track alternative fuel research some are worried a serious crisis will develop.

Tuesday, May 13, 2008

Well, it used to be cheap to live in the burbs

The main article behind the post talks about the rising cost of fuel cutting into the family budget for car-dependant commuters. Fuel prices in Sydney are approaching $1.50 per litre and some estimate it could rise to $2.00 over the next couple years which would equate to about 6% of income for those who commute. Add to this an inadequate transit system and the lack of government to fast track alternative fuel research some are worried a serious crisis will develop.

Thursday, May 8, 2008

Vancouver prices continue to rise

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

CMHC is still bullish on the Vancouver market calling for an overall 8% increase in 2008 and another 5% for 2009. CMHC is hanging its hat on job and population growth despite their speculation that the decline we are seeing is in part, a result of events in the US real estate market causing fear and investors wanting to ring the register and take their profits. They also noted that resales, a measure of investors flipping houses, is also down.

Final thoughts: First, to all those flippers who have taken your profits and are sitting on the sidelines planning your next investment, well done.

To those who are still in the game looking for another 10%, remember this saying: the bulls make money, the bears make money but pigs just get slaughtered.

The predicted 8% an 5% increase for 2008 and 2009 respectively is a possibility however it may also be very optimistic.

Lets not forget following:

Vancouver is the most expensive city in Canada taking 67% of your income to buy the average house.

Mortgage rates haven't fully followed the current rate cuts by the Bank of Canada.

Sub-prime mortgages they say is a small portion of mortgages in Canada but what about zero down and 40 year amortizations. I am certain with the affordability factor the way it has been over the last couple of years there are a behemoth of first-time homeowners with these mortgages. Not to mention, until this credit crisis hit, the lending intuitions in Canada were also like the US and giving away cash.

How about the "real" inflation we are getting hit with, you know the inflation that includes the basic necessities like fuel, food and housing costs.

Finally, I believe this this massive run up in real estate value and record sales in Vancouver is the result of the ability for just about anyone with a heart beat to get a mortgaged over the last 5 +/- years. In other words, the buyers of tomorrow are already strapped with a massive mortgage.

So we are different than the US and we don't have the sub-prime problem but that doesn't mean we won't have a meltdown - Canadian style.

Monday, May 5, 2008

Wary of realty speculators

This article talks about how developers working in the Vancouver, BC real estate market are refusing to sign pre-sale deals to suspected speculators.

The developers are concerned that if the market flattens speculators will just walk away from the deal before the building is finished complicating financing which is dependant upon the number of units pre-sold in the building.

In this particular story the developer blames the marketing company for attracting speculators, however speculators are and will always be a part of a booming market.

Final thoughts: A quick search of Craigslist shows 421 assignments offered in the Vancouver area. What is not known are the number of assignments that are unknowingly transferred from speculator to speculator.

There are plenty of quasi-investors out there who think this market has another 3 plus years to run. I am not saying they are wrong, however the evidence to the contrary is starting to build.

This storey of the developer being concerned about speculators buying in their building tells me they are concerned about the strength of the real estate market over the next couple of years. The financing aspect is just the fallout of a declining market. When real estate values decline, speculators and would-be owners alike will walk away from these assignments.