Sunday, June 1, 2008

Weekend round-up

Thursday, May 29, 2008

How long will the slowdown last?

For many real estate executives, 2008 is the year of radical changes. Building sales through the first five months of the year in New York's investment sales market have been moving at a snail's pace. Investment sales executives are marketing plenty of office and residential properties, yet very few are actually closing and investment sales are down by as much as 80%.

Read Full Story

Tuesday, May 27, 2008

The Wrong Side of a Real Estate Slump

A good article that imparts advice on how to sell in a down market. For those people in areas where the market is still holding up - this information is still relevant. Whether you are trying to keep yourself out of foreclosure, trying to maximize your return or flip quickly, these rules apply.

The problem with most people is that they are greedy. The fact that they have, say, a $50,000 to $75,000 + gain in home value in 9 to 12 months without lifting a finger to improve the home isn't good enough, they want that extra $10,000. In an increasing market this home will sell, not in two to three weeks but two to three + months when the market catches up with the asking price.

This greed aspect also holds true in declining markets. I understand that people don't want to lose money, but by having unrealistic expectations of what prospective buyers should you for your property will expand your loses in the end.

Final thoughts: All the points in the article I believe are helpful but by far "Price it right" is essential to quickly selling any property in any market. Time lost by holding out for that extra dollar is keeping you from getting your profit out of the deal and moving on to your next investment.

Sunday, May 25, 2008

Weekend round-up

Thursday, May 22, 2008

Real estate bloggers can protect themselves from libel lawsuits

Here is an article relevant to real estate bloggers and posters. This question and answer article broadly covers the issue of libel and being sued for inaccurate or defamatory comments.

Since most bloggers in this space are "home-bloggers" (professionals or people blogging from their home computer) they may not have an understanding of the kind of posts and comments that could result in a lawsuite.

Final thoughts: If you are a blogger or regularly participate in commenting on blogs or forums, this article is worth the read.

Wednesday, May 21, 2008

First Nations housing market

The Government of Canada is introducing a new financing plan that will allow First Nations people living on reserve to build, buy or renovate a house on-reserve.

The plan has three stakeholders; the Canadian Government (a.k.a the taxpayer), Canadian financial institutions and First Nations organizations.

The intention of the program is to create an on-reserve housing market that will encourage investment and home ownership.

Essentially, the Fund is designed to provide an extra safety net for the lender in the event the borrower defaults on the loan and the First Nation does not honour its obligation to step in using its own resources, to remedy the default.

Final thoughts: One item that I am not clear on is the ownership of the underlying land. IMO the land must be part of the home ownership if this is to work.

If First Nations people can only invest in the "house" on the land, then they are paying allot of money for a depreciating asset. Under this scenario the program is a money loser for all except the lender.

There are many challenges ahead for this program to create an "investment" type housing market on a First Nations reserve. Some of these challenges are covered in this post by Grassroots News .

It will be interesting to see how this "real estate market" takes form over the long term. If you have any additional information on this please leave a post.

Monday, May 19, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

Online property sales probed - Australia

Moody's: Commercial real estate prices slipping - USA

Real estate sector growth trends - Bulgaria

5-10 percent European property fall

Real estate wary of hot foreign money - UAE

Al Gharbia set to become a real estate hot spot - UAE

Israel is still a hot market for high-end real estate

Africa: Asset Managers Look to Continent

Japan faces backlog of unsold homes

Thursday, May 15, 2008

Hawaiian home away from home

The main draw for foreigners seem to be in the $500,000 + luxury home and condo sector as many see this market as currently having good value with great future growth potential.

Sales volume has cooled off from its highs in 2005 and with the weak US dollar, many foreigners are buying up luxury condos and houses for investment and vacation homes.

One realtor comments, "Maui inventory is much more available and affordable. The period of "irrational exuberance" in the Real Estate Market is over for now. There has been a correction and the over inflated priced homes do not sell. The market seems to have stabilized in the recent months."

Final thoughts: A quick search showed vacation rentals in the $120.00 per night for a 2 bedroom 2 bath condo.

I looked around an MLS site and there are plenty of options for less than $300,000.

It would require more investigation but on the surface it looks like one could purchase a decent condo around the $200,000 mark and have tourists pay it off.

If you are interested in a vacation home in Hawaii it's worth looking into.

Wednesday, May 14, 2008

REIT's and Real Estate Funds

Looking for the next real estate play? Real Estate Investment Trusts and Real Estate Funds are worth a look.

In the US, a Wall Street Journal article states; "The average real-estate fund, which lost more than 14% on average in 2007, is up nearly 5.6% this year through May 12, which makes it the second-best performing U.S. stock fund group this year, behind the hot natural-resources funds category."

The Jerusalem Post in Israel quoted; "The current crisis that started with the sub-prime fiasco has [affected] real estate prices all over the world. It is now possible to buy real estate for rental purposes at prices that are lower by up to 20% from a year ago, and I believe prices will fall more. The current prices are hurting many, but for those companies or individuals with ready cash, it has created attractive investment opportunities. "

If you are interested in these real estate investment vehicles, China is one of the places to put on your radar. A storey in The Sydney Morning Herald printed this; "As the fastest growing real estate market, with substantial commercial property assets that are of investment grade, China has the potential to be an REIT phenomenon if the legislation for such a market is put in place."

Final Thoughts: There are several real estate markets around the world that are still growing.

In markets such as the US, the price to get into these types of investments are cheap compared to previous levels.

There is talk out there in the msm covering how these trusts and funds got beat down in 2007 and the upside potential that is beginning to take shape. Now is the time to investigate. If you wait to hear about it on the evening news before you make a move...well need I say more.

Today's Quote: Owning a home is a keystone of wealth.. both financial affluence and emotional security. Suze Orman

Tuesday, May 13, 2008

Well, it used to be cheap to live in the burbs

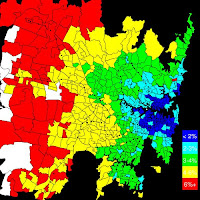

The main article behind the post talks about the rising cost of fuel cutting into the family budget for car-dependant commuters. Fuel prices in Sydney are approaching $1.50 per litre and some estimate it could rise to $2.00 over the next couple years which would equate to about 6% of income for those who commute. Add to this an inadequate transit system and the lack of government to fast track alternative fuel research some are worried a serious crisis will develop.

Sunday, May 11, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

International Real Estate Investment: What Investors Should Know - General

Media to blame for slump, say real estate agents - New Zealand

Global wealth boom to trigger a 77pc surge in millionaires - World

India Real Estate Expo 2008 - USA

REAL ESTATE: Outlook tough for sellers - USA

Foreign buyers snap up US real estate - USA

Property in the Caribbean: St Lucia goes bananas for property - Caribbean

Can UAE real estate boom dodge US slow down? - Middle East

International buyers eye Canadian real estate - Canada

Thursday, May 8, 2008

Vancouver prices continue to rise

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

CMHC is still bullish on the Vancouver market calling for an overall 8% increase in 2008 and another 5% for 2009. CMHC is hanging its hat on job and population growth despite their speculation that the decline we are seeing is in part, a result of events in the US real estate market causing fear and investors wanting to ring the register and take their profits. They also noted that resales, a measure of investors flipping houses, is also down.

Final thoughts: First, to all those flippers who have taken your profits and are sitting on the sidelines planning your next investment, well done.

To those who are still in the game looking for another 10%, remember this saying: the bulls make money, the bears make money but pigs just get slaughtered.

The predicted 8% an 5% increase for 2008 and 2009 respectively is a possibility however it may also be very optimistic.

Lets not forget following:

Vancouver is the most expensive city in Canada taking 67% of your income to buy the average house.

Mortgage rates haven't fully followed the current rate cuts by the Bank of Canada.

Sub-prime mortgages they say is a small portion of mortgages in Canada but what about zero down and 40 year amortizations. I am certain with the affordability factor the way it has been over the last couple of years there are a behemoth of first-time homeowners with these mortgages. Not to mention, until this credit crisis hit, the lending intuitions in Canada were also like the US and giving away cash.

How about the "real" inflation we are getting hit with, you know the inflation that includes the basic necessities like fuel, food and housing costs.

Finally, I believe this this massive run up in real estate value and record sales in Vancouver is the result of the ability for just about anyone with a heart beat to get a mortgaged over the last 5 +/- years. In other words, the buyers of tomorrow are already strapped with a massive mortgage.

So we are different than the US and we don't have the sub-prime problem but that doesn't mean we won't have a meltdown - Canadian style.

Wednesday, May 7, 2008

The best and the worst of the US real estate market

We all aware of the real estate slump in the US and how it is expected to continue for the next couple of years before we see a bottom.

Here is a sample of some of the steepest declines in residential real estate since the peak of the market in 2005/2006:

Detroit, MI -24.5%

Miami, FL -23.7%

Sacramento, CA -30.2%

These and other areas are forecasted to continue falling another -15% to -24% over the next 12 months.

Not all areas are facing such steep declines and look more like a return to a balanced market. What has only been a whisper in the msm are those real estate markets in the US that are holding up and even predicted to see an increase in home values over the next 12 months. When considering that the median asking prices are in the $100,00 to $200,000 range, one can conclude these were not "hot" markets in the first place.

Final thought: I am going to paraphrase a quote from Noel Whittaker, Rich Assets Real Estate that I thought was fitting and true to a fault.

The property boom has made us all feel wealthy, but unfortunately it has lulled many into a false sense of security.