Sunday, June 1, 2008

Weekend round-up

Thursday, May 29, 2008

How long will the slowdown last?

For many real estate executives, 2008 is the year of radical changes. Building sales through the first five months of the year in New York's investment sales market have been moving at a snail's pace. Investment sales executives are marketing plenty of office and residential properties, yet very few are actually closing and investment sales are down by as much as 80%.

Read Full Story

Tuesday, May 27, 2008

The Wrong Side of a Real Estate Slump

A good article that imparts advice on how to sell in a down market. For those people in areas where the market is still holding up - this information is still relevant. Whether you are trying to keep yourself out of foreclosure, trying to maximize your return or flip quickly, these rules apply.

The problem with most people is that they are greedy. The fact that they have, say, a $50,000 to $75,000 + gain in home value in 9 to 12 months without lifting a finger to improve the home isn't good enough, they want that extra $10,000. In an increasing market this home will sell, not in two to three weeks but two to three + months when the market catches up with the asking price.

This greed aspect also holds true in declining markets. I understand that people don't want to lose money, but by having unrealistic expectations of what prospective buyers should you for your property will expand your loses in the end.

Final thoughts: All the points in the article I believe are helpful but by far "Price it right" is essential to quickly selling any property in any market. Time lost by holding out for that extra dollar is keeping you from getting your profit out of the deal and moving on to your next investment.

Sunday, May 25, 2008

Weekend round-up

Thursday, May 22, 2008

Real estate bloggers can protect themselves from libel lawsuits

Here is an article relevant to real estate bloggers and posters. This question and answer article broadly covers the issue of libel and being sued for inaccurate or defamatory comments.

Since most bloggers in this space are "home-bloggers" (professionals or people blogging from their home computer) they may not have an understanding of the kind of posts and comments that could result in a lawsuite.

Final thoughts: If you are a blogger or regularly participate in commenting on blogs or forums, this article is worth the read.

Wednesday, May 21, 2008

First Nations housing market

The Government of Canada is introducing a new financing plan that will allow First Nations people living on reserve to build, buy or renovate a house on-reserve.

The plan has three stakeholders; the Canadian Government (a.k.a the taxpayer), Canadian financial institutions and First Nations organizations.

The intention of the program is to create an on-reserve housing market that will encourage investment and home ownership.

Essentially, the Fund is designed to provide an extra safety net for the lender in the event the borrower defaults on the loan and the First Nation does not honour its obligation to step in using its own resources, to remedy the default.

Final thoughts: One item that I am not clear on is the ownership of the underlying land. IMO the land must be part of the home ownership if this is to work.

If First Nations people can only invest in the "house" on the land, then they are paying allot of money for a depreciating asset. Under this scenario the program is a money loser for all except the lender.

There are many challenges ahead for this program to create an "investment" type housing market on a First Nations reserve. Some of these challenges are covered in this post by Grassroots News .

It will be interesting to see how this "real estate market" takes form over the long term. If you have any additional information on this please leave a post.

Monday, May 19, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

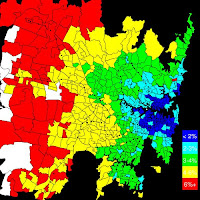

Online property sales probed - Australia

Moody's: Commercial real estate prices slipping - USA

Real estate sector growth trends - Bulgaria

5-10 percent European property fall

Real estate wary of hot foreign money - UAE

Al Gharbia set to become a real estate hot spot - UAE

Israel is still a hot market for high-end real estate

Africa: Asset Managers Look to Continent

Japan faces backlog of unsold homes

Thursday, May 15, 2008

Hawaiian home away from home

The main draw for foreigners seem to be in the $500,000 + luxury home and condo sector as many see this market as currently having good value with great future growth potential.

Sales volume has cooled off from its highs in 2005 and with the weak US dollar, many foreigners are buying up luxury condos and houses for investment and vacation homes.

One realtor comments, "Maui inventory is much more available and affordable. The period of "irrational exuberance" in the Real Estate Market is over for now. There has been a correction and the over inflated priced homes do not sell. The market seems to have stabilized in the recent months."

Final thoughts: A quick search showed vacation rentals in the $120.00 per night for a 2 bedroom 2 bath condo.

I looked around an MLS site and there are plenty of options for less than $300,000.

It would require more investigation but on the surface it looks like one could purchase a decent condo around the $200,000 mark and have tourists pay it off.

If you are interested in a vacation home in Hawaii it's worth looking into.

Wednesday, May 14, 2008

REIT's and Real Estate Funds

Looking for the next real estate play? Real Estate Investment Trusts and Real Estate Funds are worth a look.

In the US, a Wall Street Journal article states; "The average real-estate fund, which lost more than 14% on average in 2007, is up nearly 5.6% this year through May 12, which makes it the second-best performing U.S. stock fund group this year, behind the hot natural-resources funds category."

The Jerusalem Post in Israel quoted; "The current crisis that started with the sub-prime fiasco has [affected] real estate prices all over the world. It is now possible to buy real estate for rental purposes at prices that are lower by up to 20% from a year ago, and I believe prices will fall more. The current prices are hurting many, but for those companies or individuals with ready cash, it has created attractive investment opportunities. "

If you are interested in these real estate investment vehicles, China is one of the places to put on your radar. A storey in The Sydney Morning Herald printed this; "As the fastest growing real estate market, with substantial commercial property assets that are of investment grade, China has the potential to be an REIT phenomenon if the legislation for such a market is put in place."

Final Thoughts: There are several real estate markets around the world that are still growing.

In markets such as the US, the price to get into these types of investments are cheap compared to previous levels.

There is talk out there in the msm covering how these trusts and funds got beat down in 2007 and the upside potential that is beginning to take shape. Now is the time to investigate. If you wait to hear about it on the evening news before you make a move...well need I say more.

Today's Quote: Owning a home is a keystone of wealth.. both financial affluence and emotional security. Suze Orman

Tuesday, May 13, 2008

Well, it used to be cheap to live in the burbs

The main article behind the post talks about the rising cost of fuel cutting into the family budget for car-dependant commuters. Fuel prices in Sydney are approaching $1.50 per litre and some estimate it could rise to $2.00 over the next couple years which would equate to about 6% of income for those who commute. Add to this an inadequate transit system and the lack of government to fast track alternative fuel research some are worried a serious crisis will develop.

Sunday, May 11, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there in your area? Post your links and thoughts.

International Real Estate Investment: What Investors Should Know - General

Media to blame for slump, say real estate agents - New Zealand

Global wealth boom to trigger a 77pc surge in millionaires - World

India Real Estate Expo 2008 - USA

REAL ESTATE: Outlook tough for sellers - USA

Foreign buyers snap up US real estate - USA

Property in the Caribbean: St Lucia goes bananas for property - Caribbean

Can UAE real estate boom dodge US slow down? - Middle East

International buyers eye Canadian real estate - Canada

Thursday, May 8, 2008

Vancouver prices continue to rise

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

With record listings, year over year sales down and prices in some localized markets flat or slightly down, there still seems to be plenty of people who still think real estate prices only go in one direction - up.

CMHC is still bullish on the Vancouver market calling for an overall 8% increase in 2008 and another 5% for 2009. CMHC is hanging its hat on job and population growth despite their speculation that the decline we are seeing is in part, a result of events in the US real estate market causing fear and investors wanting to ring the register and take their profits. They also noted that resales, a measure of investors flipping houses, is also down.

Final thoughts: First, to all those flippers who have taken your profits and are sitting on the sidelines planning your next investment, well done.

To those who are still in the game looking for another 10%, remember this saying: the bulls make money, the bears make money but pigs just get slaughtered.

The predicted 8% an 5% increase for 2008 and 2009 respectively is a possibility however it may also be very optimistic.

Lets not forget following:

Vancouver is the most expensive city in Canada taking 67% of your income to buy the average house.

Mortgage rates haven't fully followed the current rate cuts by the Bank of Canada.

Sub-prime mortgages they say is a small portion of mortgages in Canada but what about zero down and 40 year amortizations. I am certain with the affordability factor the way it has been over the last couple of years there are a behemoth of first-time homeowners with these mortgages. Not to mention, until this credit crisis hit, the lending intuitions in Canada were also like the US and giving away cash.

How about the "real" inflation we are getting hit with, you know the inflation that includes the basic necessities like fuel, food and housing costs.

Finally, I believe this this massive run up in real estate value and record sales in Vancouver is the result of the ability for just about anyone with a heart beat to get a mortgaged over the last 5 +/- years. In other words, the buyers of tomorrow are already strapped with a massive mortgage.

So we are different than the US and we don't have the sub-prime problem but that doesn't mean we won't have a meltdown - Canadian style.

Wednesday, May 7, 2008

The best and the worst of the US real estate market

We all aware of the real estate slump in the US and how it is expected to continue for the next couple of years before we see a bottom.

Here is a sample of some of the steepest declines in residential real estate since the peak of the market in 2005/2006:

Detroit, MI -24.5%

Miami, FL -23.7%

Sacramento, CA -30.2%

These and other areas are forecasted to continue falling another -15% to -24% over the next 12 months.

Not all areas are facing such steep declines and look more like a return to a balanced market. What has only been a whisper in the msm are those real estate markets in the US that are holding up and even predicted to see an increase in home values over the next 12 months. When considering that the median asking prices are in the $100,00 to $200,000 range, one can conclude these were not "hot" markets in the first place.

Final thought: I am going to paraphrase a quote from Noel Whittaker, Rich Assets Real Estate that I thought was fitting and true to a fault.

The property boom has made us all feel wealthy, but unfortunately it has lulled many into a false sense of security.

Tuesday, May 6, 2008

Real estate bargains in high-growth areas of the world

Monday, May 5, 2008

Wary of realty speculators

This article talks about how developers working in the Vancouver, BC real estate market are refusing to sign pre-sale deals to suspected speculators.

The developers are concerned that if the market flattens speculators will just walk away from the deal before the building is finished complicating financing which is dependant upon the number of units pre-sold in the building.

In this particular story the developer blames the marketing company for attracting speculators, however speculators are and will always be a part of a booming market.

Final thoughts: A quick search of Craigslist shows 421 assignments offered in the Vancouver area. What is not known are the number of assignments that are unknowingly transferred from speculator to speculator.

There are plenty of quasi-investors out there who think this market has another 3 plus years to run. I am not saying they are wrong, however the evidence to the contrary is starting to build.

This storey of the developer being concerned about speculators buying in their building tells me they are concerned about the strength of the real estate market over the next couple of years. The financing aspect is just the fallout of a declining market. When real estate values decline, speculators and would-be owners alike will walk away from these assignments.

Saturday, May 3, 2008

Weekend round-up

Here is a collection of real estate articles from around the world to comment on. What are you seeing out there? Post your links and thoughts. Have a great weekend!

Greater Vancouver real estate sales slip, listings jump

Inflation first-aid kit: Gold, oil and real estate

Do homework before buying - recreation properties

Canadians want piece of paradise

Upgrading Taiwanese real estate

Dubai World hangs in there in battered US market

Housing industry overheating for Trinidad and Tobago.

Fed Cuts Rate As US House Price Slides Accelerates

Thursday, May 1, 2008

Prince George worth a look

The City is a centre for mining companies that operate in Central B.C. There are reports that indicate along with the current mining of minerals the area is showing promise of petroleum resource potential.

Prince George is also at the cross-roads to the northwest coast where there are a number of new projects in play to support shipping to the orient.

Century 21 reports that values are essentially flat year over year while the B.C. Northern Real Estate Board claims the average Prince George house price is up six per cent this year.

CMHC reports the vacancy rate as of October 2007 for all apartments in the city stood at just 1.9 per cent down from 2.6 per cent the year before.

Housing starts were down slightly in March and also year to date however this is not indicative of a trend this early in the year.

Prince George is also a major shopping centre for many surrounding communities within a one to two hours drive.

Final though: A quick MLS search showed a multitude of housing options under $200,000

Wednesday, April 30, 2008

Agriculture the next real estate play

If we look at it from a real estate perspective, farmland is the obvious place to be. Assuming a 10 year boom in the commodity market plays out, real estate values of farmland will skyrocket. I base this primarily on the limited supply of farmland and adding another billion people to the world population by 2020. In addition to this, farmland around the world is decreasing due to development and loss of ground water .

The Spring 2008 Farmland Values Report released by Farm Credit Canada says the following:

"The average value of Canadian farmland increased 7.7 per cent during the last six months of 2007, Canada's highest increase since 2002. This is higher than the 3.6 per cent increase in the first six months of 2007.

Most provinces continue to see growth in farmland values, with British Columbia experiencing a huge 14.5 per cent increase. Overall increases are consistent with an upward trend in land values since January 2000.

With the largest increase in B.C. at 14.5 per cent, Alberta shows the second largest increase at 10.3 per cent. Saskatchewan follows closely behind with an average 7.8 per cent increase and Manitoba is experiencing a similar per cent increase of 7.3 per cent.

Quebec shows an increase of 3.6 per cent, while Ontario's farmland values increased slightly at 1.2 per cent during the last six months of 2007.

Atlantic Canada land values varied, with Nova Scotia showing a 3.1 per cent increase, while Prince Edward Island and New Brunswick indicating decreases of 1.4 per cent and 3.3 per cent, respectively. Newfoundland and Labrador land values remained the same in the second half of 2007. "

Final thought: For all those times you wish you would have jumped into the market early and made your fortune, now is the time to investigate the future follow the money and make your play.

Tuesday, April 29, 2008

Calgary is leading the real estate decline

This article talks about Calgary leading the pack of the four most active provinces in resale housing activity.

"A report released Tuesday by the Canadian Real Estate Association says MLS sales in the province were down 30.5 per cent compared with the first quarter of 2007, new listings increased by 36.2 per cent, total dollar volume of all transactions dropped by 26.7 per cent but the average sale price increased by 5.4 per cent to $361,544."

REM: The question is, how long will this "balanced market" and "modest price gains" last? My call is that we will pass by the "balanced market" on our destination to a buyers market.

The duration the market will hold a balance I believe is directly linked to the number of people/quasi-investors who have been holding on to hit the top of the market before selling.

There still seems to be a fair number of people I talk to who believe the market will continue on a 5% -10% gain over the next couple of years (at least in Vancouver BC). The problem with timing the top of the market is that you don't see the top until it has already passed by.

I will leave you with this Wall Street truism as a final thought: Bulls Make Money, Bears Make Money, Pigs Get Slaughtered.

Monday, April 28, 2008

Banks Reluctant To Pass On Rate Cuts

There are signs the Bank of Canada and the U.S. Federal Reserve are running out of room to deliver further interest rate relief to their economies.

Commercial banks in Canada are showing an increasing reluctance to pass on the central bank's rate cuts, and further Fed cuts are expected to run into opposition from members who are starting to fear inflation more than recession.

REM: Real estate may be leveling off to a more "balanced market" however the balance of 2008 will tell the real storey. We could even begin to see a shift in some Canadian markets in the next couple months since the spring is typically the most active months of the cycle. There are a few items I think will impact the real estate market in the not so distant future: recession fears, the impact of the banks holding back on mortgage rate cuts, fears of global inflation impacting Canada and highly leveraged first-time buyers .

Wednesday, April 9, 2008

Looking for a Vacation Home Amigo?

I just got back from a well deserved vacation in Mexico. While I am back to my day-to-day routine my mind is still in Puerto Vallarta. The weather was excellent, the ocean was warm and the locals are great people. Although, just getting away from the rainy cold weather of the west coast would make anyplace with a temperature above 15 degrees seem like paradise.

What interested me most about Puerto Vallarta was the real estate investment possibilities. You can get into this market for as little as $80k US for a 2 bdrm - 2 bath condo however I'm sure "you get what you pay for" applies. There are several options for condos not on the beach but within waking distance priced in the $140 to $200K range. Beach condos will cost you an easy $500,000 to $1,000,000 plus. There are also options for buying a house for those interested.

With vacation rental fees in the $100 to $200 USD per night for a 2 bdrm - 2 bath condo close to amenities but not on the beach, purchasing one with a positive cash flow should be attainable.

The limited market research I did while on vacation indicated that the real estate market in Puerto Vallarta has been experiencing a 5 year boom with some signs of a turn. Such as the number of listings increasing over the previous year and speculation that the US credit problems will somewhat weaken the real estate market in Mexico.

There are a few things we can take from this; first, every boom runs out of steam and is followed by a pullback at some point.

Next, this market is also predominantly driven by US buyers. Now that the consensus amongst most experts is that the US is in a recession, discretionary spending on a vacation home should decline.

In addition, real estate markets in some US states like Florida and California are a buyers market increasing the competition for vacation properties in general.

Finally, the US sub prime impact. I don't think that this alone will have a major impact on the real estate market in Mexico for the following reasons:

* most sub prime loans were made to people whom could not afford their first home.

* others who got caught up by the easy money availability invested locally.

That being said, the current tightening of credit availability will have some impact on the vacation home market the question is just how much.

The vacation home market in general has been strong for the past several years in most areas and some markets will continue to remain strong in the future due to demand from retiring baby boomers with cash to burn. However not all these markets will play out the same.

If you have been considering purchasing a vacation home now is the time to start researching and paying attention to the local real estate market you are interested in.

Wednesday, March 26, 2008

B.C. sales figures rank dead last among provinces

Retail sales in B.C. placed dead last among the provinces in January in an underwhelming performance one economist suggests may be a blip.

B.C. was the only province in Canada to see a sales decline in January as month-over-month sales shrank by 0.2 per cent, Statistics Canada said yesterday.

Nationally, retail sales rose by 1.5 per cent, buoyed by Canadians' hunger for cars, clothes, building supplies and furniture.

Business Council of B.C. economist Jock Finlayson said B.C.'s sales figures are a bit puzzling given the province's strength in other economic areas such as the labour market.

"We have had quite strong retail sales until this report, so I wouldn't jump to a conclusion based on one month," Finlayson said.

"It could very well be a blip rather than a sign of any fundamental slowdown of retail sales."

REM: This may be a blip however I have one associate who works for a large furnitue distributor and he claims shipments to individual stores are down when compared to the same period over the last few years.

Tuesday, March 18, 2008

Market Numbers

Click on the image for a larger view. REM: The numbers are up across the board. Any predictions for the market for the remainder of the year?

REM: The numbers are up across the board. Any predictions for the market for the remainder of the year?

Monday, March 17, 2008

Greater Fool: The Troubled Future of Real Estate

He writes that a reckoning is imminent because we've been as greedy as Americans, who are enduring their worst real estate deflation since the 1930s. He takes issue with claims that our banks are prudent, arguing that zero-down mortgages and 40-year amortizations are useful only to speculators and people who can't really afford to be in the game.

He also cites recent reports that personal debt levels in Canada are at record highs and savings rates at record lows, leaving many short on options should hard times hit.

"An anti-real estate mood has swept America. Within months it will be here," he declares. He claims that suburban trophy houses in some areas of the GTA are lingering on the market and falling in value. He says the collapse will be widespread and long-lasting, in part because boomers will flood the market with houses to finance their retirements – especially since so few employees outside the public sector have much in the way of pension prospects.

His scenario gets scarier, if you fear that manufacturing jobs are in danger due to the strong Canadian dollar and the likelihood the U.S. will slip into recession. The logic is that it won't take many deeply indebted, freshly unemployed people to trigger a wave of desperation selling. That, in turn, would drag down property values for entire neighbourhoods, leaving many people with mortgages worth substantially more than their homes.

It's that situation that caused an estimated 1 million Americans to walk away from their homes last year, with predictions that twice that number will follow in 2008.

Frightened enough yet?

Well, unless you're already struggling to carry a huge mortgage with a long amortization on a large house on some car-dependent patch of suburbia, you can almost certainly relax. But you might want to include a read of Greater Fool as part of that relaxation – no matter what your circumstances are.

Wise investors diversify their portfolios, but by some estimates, most Canadian households have more than 80 per cent of their wealth tied up in real estate. And Turner is correct to point out that many, if not most, people are deluded by real estate mythology. Many believe it's always better to own than rent. Many think prices always rise. Many see real estate as a foolproof route to financial freedom, even though history has shown that at times real estate can be a great destroyer of wealth.

Turner is also correct to point out that economists employed by large real estate firms, banks and mortgage insurers tend to be quoted uncritically in Canadian media.

But try to find a respected Canadian economist who buys into Turner's pessimism. People at the University of Toronto's economics department, the Ivey School of Business at the University of Western Ontario and University of British Columbia's Centre for Urban Economics and Real Estate couldn't find one for us.

While most seem to think a gradual softening is likely after 10 years of constant price increases, a U.S.-style meltdown doesn't appear to be on anyone's radar.

"I think you will have a very tough time finding any economists who agree with Turner on this," says Tsur Somerville of UBC.

Read the entire article

REM: This book has been recently released. If you have read it, and would like to write a review on this book I will consider posting it on this site. All other comments and feedback are appreciated.

Friday, March 14, 2008

Central banks apply a costly Band-Aid

Harvey Enchin

The Vancouver Sun

Friday, March 14, 2008

World markets, including Japan's, rebounded Tuesday after an infusion of money from major central banks.

If there were any doubt that the world is in the throes of a financial crisis, moves by central banks in Europe, Canada and the United States this week confirmed our worst fears.

While their methods seem arcane -- establishing a "term securities lending facility," for instance -- their goal is painfully obvious: To avert a run on the banks and the failure of major financial institutions.

Such a calamitous outcome seems unthinkable sitting comfortably in Canada where the economy west of Thunder Bay still sizzles and the housing market crash south of the border has yet to depress local real estate prices.

But the key to what makes a capitalist economy work is also its greatest weakness -- leverage. Every time a financial institution initiates a transaction, it posts collateral to make good on a trade, explains Levente Mady, fixed-income strategist for MF Global, one of the largest financial intermediaries in the world.

When the housing bubble burst in the U.S., the alphabet soup of acronyms that represent derivatives of mortgage loans and other financial instruments were undermined and financial institutions no longer could be assured that the collateral offered to back a transaction was worth the value ascribed to it. In short, financial institutions didn't trust each other. And a financial institution unable to lend or borrow is toast.

To grease the gears of commerce, central banks do something mysterious; they inject liquidity into the system. It's a meaningless phrase to those outside the inner circle of economists, policy wonks, financial analysts, bankers, brokers and others who actually find this stuff interesting, but the latest move by the U.S. Federal Reserve illustrates how it is accomplished.

The Fed has given senior dealers -- the 20 banks and investment houses that deal directly with it -- an offer they can't refuse. In exchange for their illiquid debt, including mortgage-related securities, the Fed will lend them government-guaranteed securities, such as treasury bonds, which those financial institutions can then lend to other firms for cash. This follows similar earlier schemes, such as the Temporary Auction Facility that allowed banks to use mortgage-backed securities and other dubious structured investments as collateral at 85 per cent of their face value even though they are virtually worthless. The Fed began with a $30-billion program in December, raised it to $90 billion in January, bumped it up to $100 billion in February and doubled it to $200 billion on Tuesday.

This is in addition to the commitment by the European Central Bank, which has been engaged in this sort of activity for several months, to add about $45 billion to the several hundred billion previously pledged. For its part, the Bank of Canada has ponied up $4 billion in two tranches of $2 billion each but it imposes stiffer quality requirements than the American plans.

"If the Federal Reserve and other central banks weren't providing this liquidity there would be a number of very large players in big, big trouble," Mady says. Indeed, it was widely reported that the credit facility was timed to bail out Bear Stearns, a brokerage firm struggling with higher borrowing costs and mortgage-related losses that was deemed too large to be allowed to fail.

Mady blames the central banks for creating the now rapidly-deflating liquidity bubble in the first place, dating back to 2002 when interest rates were lowered to one per cent, or perhaps even earlier during the irrationally exuberant run-up in technology stocks.

The question that needs to be asked is whether some of the biggest global financial institutions are still solvent. If not, they will need to swap their dubious debt for securities backed by governments indefinitely. That's the bottom line of this costly program to shore up the balance sheets of financial institutions. Their bad bets will be covered by taxpayers.

It's difficult to fathom how these cosy arrangements between central bankers and their clients serve the public interest. Shouldn't financial institutions that make the wrong choices face more serious consequences than accounting writedowns?

Assuming the worst, that governments are paying the equivalent of hard dollars for paper worth pennies or less, the result could be a significant drain on governments' financial resources, forcing some into deficit (or increasing deficits of countries that already have them). That could mean higher taxes, reduced spending on social programs or both. The central bank swaps of good money for bad could also stoke inflation.

Meanwhile, U.S. consumers, who account for roughly 72 per cent of the American economy, are getting whacked. Many have descended into negative equity territory as house prices have dropped and credit lines were pulled. Barring some sort of intervention to relieve homeowners of their mortgage obligations, as many as two million foreclosures are expected this year alone.

Clearly, the liquidity injection is a Band-Aid that fails to address the problems underlying the global financial system's distress. The virus that has brought the world's strongest economy to its knees has to run its course.

Canada is not immune from the malaise. The manufacturing sector is already reeling and there's little reason for optimism with the Canadian dollar at or over par. Exports make up about 40 per cent of the Canadian economy and 80 per cent of our exports are destined for the U.S.

And, of course, the credit crisis has infected the stock market. Investors can try to second-guess the peaks and valleys of a volatile bear market but it's a mug's game for most of us.

The best defence, suggests MF Global's Mady, is to play defence. Looking back a couple of years from now, a government of Canada bond that secures principal and yields 2.75 per cent annually might seem like a good deal.

henchin@png.canwest.com

© The Vancouver Sun 2008

Thursday, March 13, 2008

Household spending up

Statistics Canada; Vancouver Sun

Published: Tuesday, March 11, 2008

Household spending in 2006 continued to show the effects of the strong resource economy in the West. Spending growth in Alberta surpassed all other provinces by a wide margin, and B.C.'s increase managed to beat the national average.

REM: Times were good. I wonder how the pocket book is feeling now after all that frivolous spending in 2006? Financial hangover?

Tuesday, March 11, 2008

Income Security and Stability During Retirement in Canada

Statistics Canada

March 10, 2008

Past research has shown that the Canadian pension system is relatively effective in helping seniors to stay out of poverty. However, the extent to which the pension system enables individuals and families to maintain living standards achieved during their working years after retirement (income security) is less well understood.To help fill this knowledge gap, we employ 20-year longitudinal data to track individuals as they move from age 55 through their retirement years. We use various measures of an individual's family income to study four main issues: change in income levels through retirement; the role that various income sources play in this change; variation in replacement rates through time and between poorer and richer

individuals; and, finally, the degree of long-term stability in individual incomes.For workers with average incomes, family income falls after age 60, declines until age 68, and then stabilizes at approximately 80% of the income level they had at age 55. In contrast, low income individuals (those in the bottom income quintile) experience little change in income as they move from age 55 through the retirement years, largely because of the income maintenance effects of the public pension system. They experience high levels of individual income instability in their late 50s and early 60s, but income instability falls dramatically after retirement. Individuals in the top quintile experience substantially larger income declines in retirement so that income inequality within a cohort declines as the cohort ages.

More recent groups of retirees are experiencing higher income levels than earlier cohorts, largely because of higher private pensions. Replacement rates have changed little among cohorts, however. Whether recent gains in income levels will persist in future cohorts is unknown since pension coverage has been falling among younger workers.

Monday, March 10, 2008

Metro Vancouver Housing Starts Spiked

By Derrick Penner

Vancouver Sun

Monday, March 10, 2008

VANCOUVER -- Metro Vancouver housing starts in February spiked almost 100-per-cent higher than the same month in 2008 thanks to a flurry of condominium projects in Vancouver and some main suburbs.

Builders started work on 2,446 housing units, according to Canada Mortgage and Housing Corp.'s February report, some 96 per cent more than the 949 units begun in February 2007.

And in a continuation of the affordability trend, multi-family starts outnumbered single-family-home starts by a ratio of almost eight to one.

"With apartments and townhomes being relatively less expensive than single detached housess, the demand for multiple-family homes will remain high in 2008," Richard Sam, a Canada Mortgage and Housing market analyst said in a news release.

Multiple-family starts totaled 2,174 units in February, compared with 949 in the same month of 2007. Single-family-home starts of 272 were nine-per-cent lower than the 299 started in February 2007.

For the first two months of 2008, the 3,778 housing starts are 47-per-cent higher than the 2,575 units that Canada Mortgage and housing recorded in 2007.

© Vancouver Sun

REM: Add to this 1,085 condos listed for sale on Craigslist and another 5,278 on MLS for a total of 8,809 condos on the market in Metro Vancouver.